The benefits of a tax account.

31st January looming..

Find out more about the benefits of having a tax account

26th January 2026

|

Hi everyone,

Do you have a tax account set up?

With the 31st January coming up tax payments are on everyones mind and cause stress. Setting up a tax account can help to reduce the anxiety and mean that funds are set aside (rather than spent).

This works well for individuals and companies. If you are running the business from the bank account then it can lead to a false sense of security – until the tax bill lands!

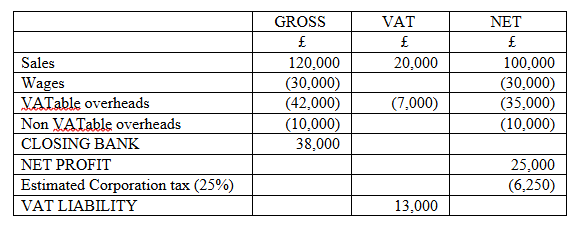

If you take £120,000 of income in this quarter then there is £20k of VAT on this and the remaining net income of £100,000 will have some corporation tax due (dependant on your costs). Each company is different but in this example lets assume the company makes net profit of 25% (ie £25,000) and the costs of £75,000 are £30k of staff wages and £45k of overheads (of which £35k of them are VATable).

The “approximate” profit and loss / tax accounts would therefore look like this: |

|

|

| So the total tax liabilities (for VAT and corporation tax) are £19,250 so really there is less than half the bank balance available (£18,750) for the business / dividends etc.

If the owner prudently set aside 20% of all income then the total in the tax account would be £24,000. The cashflow wouldn’t be stretched and when the tax fell due there would actually be a surplus of over £5,000 (which could be utilised as pension contributions or other tax planning). If you’d like to know what your tax percentage should be for your business then get in touch to arrange a call where we can run through the calculation based on your numbers. Tel: 0141 332 6331 Email: mail@russell-russell.co.uk

Take care until the next time Russell + Russell |